How to Become a Landlord? We start by defining objectives, researching local rents, vacancies, and growth, and selecting a compliant property aligned to target tenants. We model conservative cash flow, reserves, and financing options, then lock terms after inspections and appraisal.

We learn landlord-tenant laws, finalize fair, enforceable leases, and set market rents. We prepare the unit, implement management software, and establish maintenance and emergency protocols. We screen thoroughly, track records, audit compliance, and revisit assumptions quarterly. Next, we show the practical steps in detail.

Key Takeaways

- Define investment goals, budget, financing, and target returns; research local rental markets, demographics, rents, and vacancy to select a viable location.

- Choose a property aligned with target tenants; verify zoning, rental restrictions, and evaluate rent comps, condition, and projected expenses.

- Build a conservative pro forma and reserves; stress-test cash flow for vacancies, repairs, and interest rate changes; secure appropriate financing terms.

- Draft compliant leases; understand landlord-tenant laws and fair housing rules; set screening criteria and document disclosures and inspection protocols.

- Implement property management systems for leasing, rent collection, maintenance, and emergencies; maintain records, review performance, and adjust rents to market.

Table of Contents

Assess Your Market and Investment Goals

Where should we buy, and why? We start by defining measurable objectives: target cash flow, acceptable cap rate, and time horizon. Then we study market trends vacancy rates, rent growth, supply pipelines, and employment drivers to gauge durability of income. We align investment strategies to those signals: value-add if rents trail fundamentals, income-focused if stability prevails. Our risk assessment is explicit.

We model downside scenarios for rent declines, interest rate shocks, and unexpected repairs, using stress-tested debt service coverage and conservative loan-to-value. We set acquisition criteria, including yield thresholds and reserve policies, before screening deals. We validate assumptions with comparable rents and operating expenses, not broker pro formas. Finally, we commit to a decision framework that favors disciplined pacing over haste, preserving optionality and liquidity.

Choose the Right Property Type and Location

How do we translate our goals into a specific asset and address? We begin by matching our target renter with property features that limit maintenance risk and vacancy: durable finishes, functional layouts, off‑street parking, laundry, and efficient systems. Next, we map demand drivers. We scrutinize neighborhood amenities transit access, employment centers, schools, health care, parks, and retail because they support rent resilience and lower turnover.

We evaluate property type tradeoffs. Single‑family homes can attract longer tenancies; small multifamily may diversify income streams; condos shift some exterior obligations to an association but add rules and fees. We verify zoning, short‑term rental restrictions, and nuisance histories. Finally, we assess investment potential through rent comps, absorption trends, supply pipelines, climate and insurance exposures, and local governance quality to avoid fragile locations.

Run the Numbers and Secure Financing

Before we chase financing, we build a defensible deal model that stress‑tests income, expenses, and cash needs. We run a cash flow analysis using conservative rent, realistic vacancy, reserves, and maintenance. We verify taxes, insurance, utilities, and management costs, then model capex timelines. We test interest rate shocks, rent dips, and exit scenarios. If returns hold cash‑on‑cash, DSCR, and IRR we proceed.

Next, we align financing options with our investment strategies. We compare fixed versus adjustable rates, amortization lengths, prepayment penalties, and points. We evaluate conventional loans, DSCR loans, portfolio lenders, credit unions, and seller financing. We document stable income, liquidity, and net worth to satisfy underwriting. We target leverage that preserves cash buffers and maintains positive cash flow under stress. We lock terms only after third‑party inspections and appraisal.

Understand Landlord-Tenant Laws and Compliance

Even if a deal pencils, we don’t take possession until we map the legal ground we’ll operate on. We review state and local statutes, then align our leases and procedures with tenant rights, security deposit limits, notice periods, and habitability standards. We document disclosures, inspection protocols, and communication timelines to avoid ambiguity.

We train ourselves on fair housing obligations to prevent discriminatory advertising, screening, or decision-making. Our criteria are objective, consistently applied, and well documented. When conflicts arise, we follow formal dispute resolution steps before escalating.

If noncompliance persists, we execute lawful eviction processes proper notices, filing, service, hearings, and possession never self-help. We maintain records, timestamps, and receipts to support actions. Finally, we audit policies annually, monitor legal updates, and consult counsel to guarantee continuous compliance and risk control.

Prepare the Property and Set Competitive Rents

Once the legal framework is clear, we ready the asset to meet code, minimize downtime, and justify market rent. We schedule safety checks, remediate hazards, and document warranties. Strategic property upgrades durable flooring, LED lighting, low-flow fixtures reduce operating risk and signal quality. We stage clean, neutral interiors for photos and walkthroughs to accelerate absorption.

We benchmark comparables, vacancy trends, and concessions, then select pricing strategies aligned with seasonality and asset class. We set target rent, floor, and escalation logic before launch. Our rental marketing leverages high-resolution media, transparent amenity lists, and compliance-forward descriptions to build qualified interest.

| Action | Outcome |

| Code repairs | Reduced liability |

| Efficiency retrofits | Lower utilities |

| Cosmetic refresh | Faster lease-up |

| Pro photos & copy | Higher inquiries |

We reassess weekly and adjust price with data.

Screen Tenants and Execute Solid Leases

With pricing set and marketing live, we now protect yield and compliance by screening applicants methodically and contracting with rigor. We apply consistent criteria: identity verification, income-to-rent ratios, rental history, and tenant background checks covering credit, criminal, and eviction records, all in accordance with fair housing laws. We verify employment and prior landlord references, documenting decisions to maintain auditability.

Next, we deploy vetted lease agreement templates tailored to our jurisdiction. We customize lawful clauses rent due dates, late fees, occupancy limits, pet rules, insurance requirements, and notice periods avoiding unenforceable provisions. We attach required disclosures and obtain initials on key policies.

We brief tenants on payment channels and house rules, then execute electronically with secure signatures. We include addenda referencing local eviction process guidelines, defining default triggers, cure periods, and remedies.

Manage Operations, Maintenance, and Repairs

Although leasing sets expectations, disciplined operations sustain performance and legal compliance. We standardize workflows, document every action, and track obligations. We implement property management software to centralize leases, rent collection, communications, and work orders. With clear roles, we prevent gaps that create liability.

We adopt maintenance scheduling strategies: seasonal inspections, filter replacements, smoke/CO testing, roof and drainage checks, and appliance service intervals. We log asset lifecycles and warranties, then budget lead times for parts and vendor availability. Tenants receive clear service levels and submission channels.

We establish emergency repair protocols for loss of heat, active leaks, electrical hazards, and security breaches. A 24/7 hotline, vendor escalation tree, and incident documentation protect residents and reduce damage. Post-incident reviews refine processes and vendor performance.

Plan for Taxes, Insurance, and Long-Term Growth

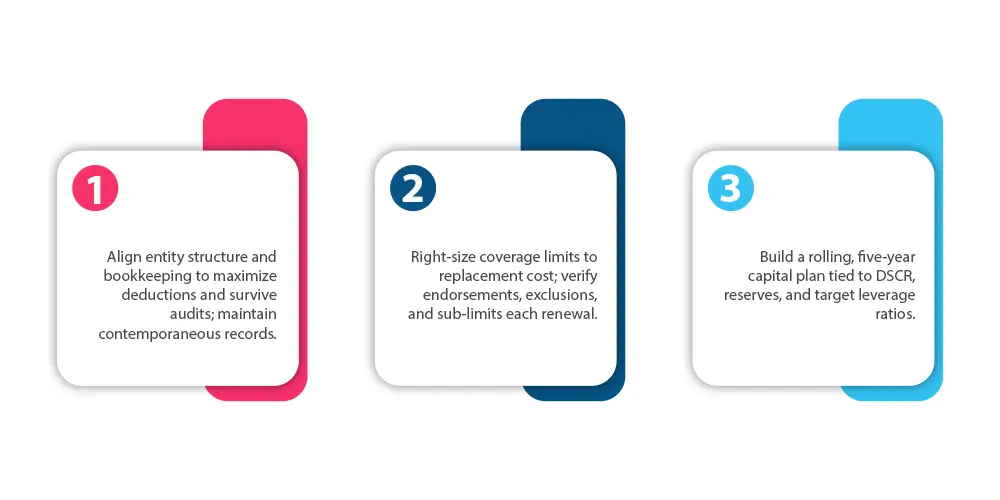

Even as operations stabilize, we treat taxes, insurance, and growth as a single, integrated plan that protects cash flow and compounds returns. We map tax deductions strategies to our asset mix, documenting basis, depreciation schedules, interest, and allowable expenses. Simultaneously, we audit insurance policy types landlord, umbrella, liability, loss-of-rent, and flood balancing premiums against exposure and deductibles. For expansion, we apply growth forecasting methods that stress-test rent, vacancy, cap rates, and financing terms.

We revisit assumptions quarterly and adjust decisively to preserve resilience.

Frequently Asked Questions

How Do I Transition From Homeowner to Landlord With Current Occupants?

We start by clarifying intentions with occupants, using tenant communication strategies. We confirm tenancy status, draft lease agreement essentials, document property condition, and set payment systems. We apply property management tips: screening if needed, legal compliance, notice timelines, dispute procedures, and maintenance protocols.

What Software Tools Streamline Bookkeeping, Leasing, and Maintenance Requests?

We recommend AppFolio or Buildium for bookkeeping software, tenant management, and maintenance tracking. They centralize leases, automate payments, and standardize requests. For tighter budgets, consider Hemlane or RentRedi; we’d still export reconciliations to QuickBooks for audit readiness.

How Should I Handle Inherited Tenants and Existing Lease Terms?

We honor existing rental agreements, document tenant rights, and review compliance. We notify occupants of ownership change, maintain terms until expiration, then assess lease renewals. We address violations cautiously, follow local statutes, and negotiate amendments transparently, prioritizing continuity, safety, and legal risk mitigation.

What Strategies Reduce Vacancy During Off-Peak Rental Seasons?

We reduce off-peak vacancy with seasonal promotions, flexible leasing, and targeted marketing. We adjust pricing conservatively, pre‑lease early, optimize listings, refresh photos, offer modest move‑in credits, coordinate turnovers tightly, and retain tenants with renewal incentives and clear communication to mitigate risk.

How Do I Create an Emergency Reserve Specific to Rentals?

We establish a dedicated emergency fund equaling 3–6 months of rental expenses per property. We automate transfers, keep funds liquid, separate accounts, and reassess quarterly. We model unexpected repairs, insurance gaps, vacancies, and legal costs to calibrate reserves precisely.

Conclusion

Becoming landlords demands discipline and diligence. We assess markets, align goals, and buy the right asset—only after underwriting conservatively and securing suitable financing. We comply with laws, prepare units professionally, and price rents to balance demand and risk. We screen carefully, use enforceable leases, and maintain properties proactively to protect cash flow. We document everything, insure adequately, and plan taxes and reserves. With measured growth, continuous learning, and strict controls, we build resilient returns while safeguarding tenants and capital.