What Is Landlord Insurance? Landlord insurance is our specialized coverage for non‑owner‑occupied rentals. We protect the building (walls, roof, built‑ins), your landlord liability if tenants or guests get hurt, and lost rental income during covered repairs usually based on replacement cost, not market value. It can include other structures, ordinance or law, water backup, or vandalism, but excludes wear and tear, maintenance neglect, and floods or earthquakes without separate policies. We help you choose compliant limits and endorsements so you stay protected and informed.

Key Takeaways

- Landlord insurance protects non-owner-occupied rental properties, covering the building, landlord liability, and lost rental income during covered repairs.

- Dwelling coverage pays to repair or rebuild walls, roof, and built-in fixtures from covered perils, based on replacement cost, not market value.

- Liability coverage helps with legal defense and damages if a tenant or guest is injured due to the landlord’s negligence.

- Standard policies exclude wear and tear, maintenance issues, floods, earthquakes, tenant disputes, voluntary vacancies, and criminal acts by the landlord.

- Policy types include DP-1, DP-2, and DP-3, with optional endorsements for ordinance or law, water backup, equipment breakdown, and short-term rentals.

Table of Contents

What Landlord Insurance Covers

This point is very important to read i you really want know that What is Landlord Insurance? Clarity first: landlord insurance typically covers the property itself, your liability as the owner, and your rental income when a covered loss makes the home unlivable. We focus on three pillars: dwelling protection, landlord liability, and loss of rental income during repairs. Dwelling protection applies to the structure walls, roof, built-in fixtures when a covered peril causes damage. Liability helps with legal defense and covered damages if a tenant or guest alleges injury or property damage tied to the premises.

We set clear coverage limits aligned to replacement cost, not market value. We can schedule additional protections such as other structures, ordinance or law, equipment breakdown, and vandalism subject to underwriting. We also address debris removal and reasonable repairs. Deductibles and sublimits apply; we document them upfront.

What Landlord Insurance Typically Excludes

While landlord policies are broad, they don’t cover everything and we spell out exclusions to prevent surprises. Expect common exclusions such as wear and tear, maintenance failures, pest or mold from neglect, and intentional damage by you or an associate. Flood and earthquake typically require separate policies. We also see policy limitations around equipment breakdown, outdated wiring, and ordinance or law upgrades unless endorsed.

We address tenant related issues carefully: losses from tenants’ personal property, fair housing violations, and contract disputes aren’t covered. Loss of rent from voluntary vacancies or illegal operations is excluded. Criminal acts by you or directed by you are never covered. To close gaps, we’ll review endorsements for vandalism by tenants, ordinance coverage, and equipment breakdown, aligning coverage with your risk profile and compliance needs.

Landlord Insurance vs. Homeowners Insurance

Two similar policies serve very different purposes: homeowners insurance protects an owner-occupied residence, and landlord insurance protects a non-owner-occupied rental. We emphasize this distinction because underwriting, landlord risks, and coverage limits differ. Homeowners policies assume you live in the property, covering personal belongings and owner liability. Landlord policies prioritize the structure, loss of rental income, and landlord liability for tenant injuries or premises hazards.

In our policy comparisons, we verify that landlord coverage includes dwelling protection, fair rental value or loss-of-rents, and optional endorsements for building code upgrades or vandalism. We also confirm exclusions unique to rentals, then calibrate coverage limits to loan requirements and replacement cost. If you convert a home to a rental, we’ll help shift coverage promptly to avoid gaps and maintain compliance.

Landlord Insurance vs. Renters Insurance

Although both policies often get mentioned together, landlord insurance and renters insurance protect different parties and risks. We insure the building, landlord liability, and lost rental income from covered events. Renters insure their personal property and their own liability. Those coverage differences matter when we allocate risk, comply with leases, and respect renters rights. We disclose policy limitations clearly so you know what’s included and what’s excluded, and we encourage tenants to carry renters insurance to close gaps.

- Picture the structure: we cover the roof, walls, and systems after a fire; tenants cover their furniture, electronics, and clothes.

- Imagine a slip-and-fall: landlord liability may respond; tenants need personal liability for their guests’ injuries.

- See a burst pipe: we handle building repairs; tenants handle damaged belongings.

Types of Landlord Policies and Endorsements

Knowing who covers what sets us up to choose the right protections for the property itself. We typically start with DP-1, DP-2, and DP-3 policy variations. DP-1 is basic named-peril coverage; DP-2 expands perils and adds some building protections; DP-3 is broader, often open-peril for the dwelling. Each form allows us to set coverage limits for the structure, other structures, loss of rental income, and landlord liability.

We tailor with endorsement options. Common add-ons include ordinance or law, water backup, equipment breakdown, service line, theft of landlord-owned property, and personal injury for wrongful eviction or libel. For short-term rentals, we verify business-use endorsements. We also review vacancy and renovation clauses, ascertain compliance with lender requirements, and align limits and deductibles with documented risk tolerances.

Cost Factors and How Premiums Are Calculated

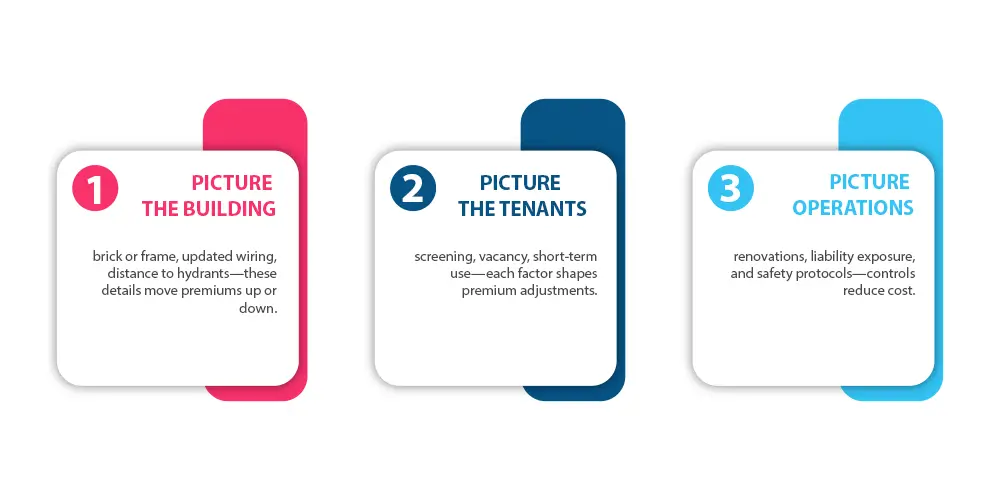

Premiums reflect risk, and insurers price landlord policies by quantifying exposure across the property, occupants, and operations. We start with a rigorous risk assessment: construction type, age, roof, and local hazards drive base rates. Occupancy patterns, prior losses, security features, and fire protection refine the model. From there, we calibrate limits, deductible options, and endorsements to align coverage with budget and compliance.

Loss history, replacement cost valuations, and jurisdictional filings finalize pricing. We document assumptions, monitor changes, and adjust premiums responsibly.

How to Choose the Right Policy for Your Property

With a clear grasp of what drives pricing, we can now focus on selecting coverage that fits your property and obligations. We start with a property assessment: construction type, year built, safety features, tenant profile, and rental income. Next, we conduct a policy comparison across carriers, verifying forms, exclusions, endorsements, and deductible options. We set coverage limits to the cost to rebuild (not market value), then add liability, loss of rent, and ordinance or law as needed. Finally, we align terms with lender requirements and local statutes.

| Step | What we verify |

| Property assessment | Rebuild cost, hazards, protections |

| Policy comparison | Exclusions, endorsements, deductibles |

| Coverage limits | Dwelling, liability, loss of rent |

| Compliance check | Lender terms, local code, notices |

We document choices and review annually or after material changes.

Tips for Filing a Claim and Avoiding Coverage Gaps

Although no one plans for a loss, we can prevent coverage gaps and speed claim payments by preparing before anything happens. Our claim documentation tips start with creating a property inventory, saving leases, inspection reports, photos, and receipts in a secure, cloud-based folder. When a loss occurs, notify the carrier immediately, mitigate damage, and follow claim timelines set in your policy and state regulations.

- Picture a labeled folder: “Roof,” “HVAC,” “Appliances,” each with dated photos and invoices proof ready for adjusters.

- Imagine a calendar with deadlines circled notice, proof of loss, contractor bids so we never miss claim timelines.

- See a walk-through video after tenant turnover clean, timestamped, and comparable.

Avoid common mistakes: delayed notice, temporary repairs without documentation, missing endorsements, and excluded perils misunderstood.

Frequently Asked Questions

Do Lenders or HOAS Require Landlord Insurance for Rental Properties?

Yes. We often see lender requirements and some HOA mandates demanding proof of landlord coverage. We’ll verify your policy meets mortgage and community rules while maximizing insurance benefits, protecting liability, property, and rental income to keep compliance seamless.

How Does Landlord Insurance Handle Short-Term Vacation Rentals?

It often excludes nightly stays unless we add short term coverage. We’ll review vacation rental exclusions, adjust policy limits, and require guest screening, permits, and platform-compliant endorsements to keep claims valid and your property compliant while hosting.

Can I Bundle Landlord Insurance With Auto for Multi-Policy Discounts?

Yes, you often can bundle. We’ll check carriers offering insurance bundling for multi policy savings. We’ll verify eligibility, property usage, and liability limits, then run a cost comparison and confirm compliance requirements before recommending the most advantageous package.

Does Landlord Insurance Affect Tenant Screening or Lease Requirements?

Yes, it can. We align tenant screening and lease terms with policy conditions, respect tenant rights, and require disclosures or coverage where permitted. These practices reduce risk, support compliance, and may positively influence insurance premiums and claim outcomes.

What Documentation Insurers Require at Underwriting, Not Just During Claims?

You’ll typically provide underwriting documentation: completed application, ownership proof, leases, prior loss runs, photos, inspections, maintenance logs, safety certifications, and rent rolls. We’ll support property valuation evidence and risk assessment details like occupancy, security measures, updates, and local compliance records.

Conclusion

As we wrap up, let’s make landlord insurance work for you. We’ll align coverage to your property, risks, and budget, guarantee key exclusions are addressed with the right endorsements, and keep liability and loss-of-rent protection front and center. We’ll compare options, verify limits, and track compliance requirements so you’re protected and audit-ready. When claims arise, we’ll guide documentation and deadlines to avoid gaps. Ready to review your policy and lock in the right protection?